Loans

COVID-19 Emergency Relief and Federal Student Aid

The U.S. Department of Education’ COVID-19 relief for student loans has ended. The 0% interest rate ended September 1, 2023, and pays restarted in October 2023. View the Federal Student Aid website for more information. Student loans held by banks are not included in this relief.

A federal student loan is money you borrow and must pay back with interest. If you decided to take out a loan, it is important to understand that a loan is a legal obligation that you will be responsible for repaying with interest. Before accepting any aid, students must review and agree to the Terms and Conditions.

To apply for a federal student loan, you must submit a Free Application for Federal Student Aid (FAFSA). The Expected Family Contribution (EFC) number generated by your FAFSA application, along with your grade level, will determine your eligibility for a Federal Direct Subsidized Loan and Federal Direct Unsubsidized Loan. Along with completing the FAFSA application, students must also be admitted as degree-seeking students and be meeting all aspects of Satisfactory Academic Progress (SAP).

An origination fee required by the federal government will be applied to each direct loan you borrow. The origination fee is a percentage of the amount of each loan you receive and is subtracted from the amount of the loan you borrow. This means the loan money you receive will be less than the amount you actually borrow. You’re responsible for repaying the entire amount you borrowed and not just the amount you received. For more information about current loan origination fees, please visit the Federal Student Aid website.

To learn more about federal student loans and how to manage your debt, visit the Federal Student Aid Gateway.

Student Loan Options

Federal Direct Loans

New Mexico State University participates in the William D. Ford Federal Direct Loan Program. Loans made through this program are referred to as Direct Loans. Eligible students and parents borrow directly from the U.S. Department of Education at participating schools. Direct Loans include Subsidized, Unsubsidized, and PLUS Loans. You repay these loans directly to the loan servicer assigned by the US Department of Education.

Direct subsidized/unsubsidized loan

Direct loans (subsidized and unsubsidized) are given to students attending school at least half-time.

- The U.S. Department of Education is the lender, and you receive the loan money through your school.

- You may receive a direct subsidized loan, a direct unsubsidized loan, or both for the same academic year.

- A student qualifies for a direct subsidized loan based on financial need, as determined under federal regulations.

- A student’s need is not a factor in determining eligibility for a direct unsubsidized loan. Students may qualify for a Direct unsubsidized loan regardless of their financial need.

- Undergraduate students may receive both subsidized and unsubsidized Direct Loans for a single academic year, if eligible. Graduate students may only receive unsubsidized direct loans.

Subsidized Direct Loan eligibility is limited to 150% of an academic program

Effective for new direct loans for which the first disbursement is made on or after July 1, 2013: Subsidized Direct Loan eligibility is limited to a maximum of 150% of the student’s current academic program length.

- Borrowers may receive subsidized Direct Loans for no more than 150% of the length of the current academic program (ex: 6 years for a 4-year degree)

- Once a borrower has received subsidized Direct Loans for 150% of the length of their program, the borrower’s future subsidized loan eligibility will end.

- A student who has received subsidized Direct Loans for 150% of the length of their program and continues enrollment beyond that point will lose all subsidies on previously received subsidized direct loans and would be required to pay all accumulated interest.

This policy is in addition to, and not in place of, the lifetime aggregate loan limits currently in place.

For more information, please review the U.S. Department of Education Federal Student Aid announcement concerning this time limitation.

Apply for Federal Direct Student Loans

(e.g. subsidized, unsubsidized, Parent PLUS, and Graduate PLUS)

Step 1. Complete the Free Application for Federal Student Aid (FAFSA)

Step 2. If you are awarded subsidized/unsubsidized loans, accept you award by completing a Federal Direct Stafford Loan Request.

Step 3: Complete Annual Student Loan Acknowledgment.

Step 4. Complete Entrance Counseling

Step 5. Complete Master Promissory Note (MPN)

It is important that all borrowers understand there are borrower rights and responsibilities that must be followed.

Fall undergraduate loan proration

For graduating undergraduate students attending only one semester of an academic year (attending and graduating the fall semester), the Financial Aid Office must prorate subsidized and unsubsidized loan amounts. Proration limits the amount of subsidized and/or unsubsidized loans a graduating student can borrow. If you have applied for fall graduation or have attempted 120 credit hours or more at New Mexico Highlands University, a financial aid advisor will recalculate your loan amounts and you will be notified with an updated financial aid award on your self-service banner account on the NMHU Portal.

Teachers in the last semester of the teaching licensure program are not subject to proration of federal direct loans; however, your cost of attendance will be changed to a fall-only term and your total financial aid award cannot exceed your total cost of attendance.

Federal Direct Parent PLUS loan

The federal direct Parent PLUS loan is an unsubsidized direct loan for parents of dependent students. A federal direct Parent PLUS loan enables parents with good credit histories to borrow money. The federal direct Parent PLUS loan does not require demonstrated financial need. Repayment begins 60 days after the last loan disbursement. To apply, parents must complete a separate federal direct Parent PLUS loan Application provided on the Department of Education’s website.

Apply for a Federal https://studentaid.gov/plus-app/Direct Parent PLUS Loan

Federal Direct Graduate PLUS loan

Students pursuing a graduate or professional degree can borrow from the Federal Direct Graduate PLUS loan program. The terms and conditions applicable to federal direct Parent PLUS loans (made to parents of dependent students) also apply to PLUS loans made to graduate and professional degree students. Unlike Parent PLUS applicants, graduate and professional degree student PLUS applicants must file a Free Application for Federal Student Aid (FAFSA).

Apply for a Federal Direct Graduate PLUS Loan

Loan Amount Limits

Dependent Students

1st year undergraduate

Subsidized: $3,500

Unsubsidized: $2,000

Total: $5,500

PLUS Denial: $4,000

2nd year undergraduate

Subsidized: $4,500

Unsubsidized: $2,000

Total: $6,500

PLUS Denial: $4,000

3rd year undergraduate

Subsidized: $5,500

Unsubsidized: $2,000

Total: $7,500

PLUS Denial: $5,000

4th year undergraduate

Subsidized: $5,500

Unsubsidized: $2,000

Total: $5,500

PLUS Denial: $5,000

Aggregate limit

Subsidized: $23,000

Unsubsidized: $8,000

Total: $31,000

Independent Students

1st year undergraduate

Subsidized: $3,500

Unsubsidized: $6,000

Total: $9,500

2nd year undergraduate

Subsidized: $4,500

Unsubsidized: $6,000

Total: $10,500

3rd year undergraduate

Subsidized: $5,500

Unsubsidized: $7,000

Total: $12,500

4th year undergraduate

Subsidized: $5,500

Unsubsidized: $7,000

Total: $12,500

Aggregate limit

Subsidized: $23,000

Unsubsidized: $34,500

Total: $57,500

Graduate student

Unsubsidized: $20,500

Total: $20,500

Graduate student aggregate limit

Unsubsidized: $138,500

Total: $138,500

Loan basics

Annual Student Loan Acknowledgment

NSLDS – The National Student Loan Data System (NSLDS) is the U.S. Department of Education’s (ED’s) central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that recipients of Title IV Aid can access and inquire about their Title IV loans and/or grant data.

Cohort Default Rate

A cohort default rate is the percentage of the school’s borrowers in the U.S. who enter repayment on certain loans during a federal fiscal year (October 1 to September 30) and default prior to the end of the next one to two fiscal years. The United States Department of Education (ED) releases official cohort default rates once per year.

Important Note: Some schools have a small number of borrowers entering repayment. Other schools have only a small portion of the student body taking out student loans. In such cases the cohort default rate should be interpreted with the caution as these rates may not be reflective of the entire school populations.

NMHU Fiscal Year 2020 Official Cohort Default Rate: 0.0

Official Cohort Default Rate Search for Schools

Borrower’s rights and responsibilities

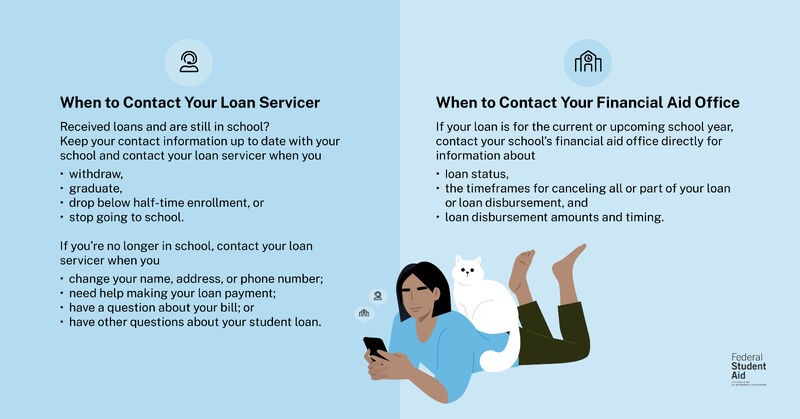

All borrowers have rights and responsibilities when borrowing federal direct loans. Borrowers are encouraged to contact their loan servicer for all repayment options.

Rights

You have the right to a grace period before your repayment period begins. (Your parents do not receive a grace period for a Federal PLUS loan).

Your grace period begins when you leave school or drop below half-time. The exact length of your grace period is shown on your promissory note.

You must be given a loan repayment schedule, which lets you know when your first payment is due, and the number, frequency, and amount of all payments.

You must be given a list of deferment and cancellation conditions and the conditions under which the Department of Defense will repay your loan.

Change your repayment plan at any time.

Prepay all or any part of the amount owed without a penalty.

Decline all or part of your loan money by notifying your school before or within 14 days after the disbursement.

Receive documentation that your loans are paid in full.

You must be notified when your loan is sold if the sale results in your making payments to a new organization. The old and new organizations must each notify you of the sale, the identity of the new organization holding your loan, the name and address of the organization to which you must make payments, and the telephone numbers of both old and new organizations.

Responsibilities

When you sign a promissory note, you’re agreeing to repay according to the terms of the note. This note is a binding legal document. This commitment to repay means that you will have to pay back the loan even if you do not complete your education, are not able to get a job after you complete the program, or you are dissatisfied with or do not receive the quality of education you received. If you do not pay back your loan on time or according to the terms in your promissory note, you may go into default, which has serious consequences.

You must make payments on your loan even if you do not receive a bill. Billing statements (or coupon books) are sent to you as a convenience, but not receiving them does not relieve you of your obligation to make payments.

If you have applied for a deferment, you still must continue to make payments until your deferment is processed. If you do not, you may end up in default. You should keep a copy of any deferment request form you have, and you should document all contacts with the organization that holds your loan.

Students are required to make monthly payments on their loans after they leave school unless they are in deferment or forbearance. They are also responsible to notify the Direct Loan Servicing Center of anything that might alter their eligibility for an existing deferment.

Contact the Direct Loan Servicing Center and NMHU Financial Aid if you:

Withdraw, graduate or fail to enroll in school

Register for or drop to a less than half-time status

Transfer to another school

Change your name, address, phone number or Social Security Number

Change your expected date of graduation

Before you receive your first disbursement, you must complete an entrance counseling session and, before you leave school, you must complete an exit counseling session.

Federal loan repayment options

Loans begin to go into repayment when a borrower does the following:

Graduates from school

Drops below half-time enrollment

Withdraws from school

Takes a leave of absence

Federal Direct Loans does provide the option to make payments before your repayment period begins without penalty.

What are my repayment options?

Where do I send my payments?

If you have a federal Direct Loan, please send your payment to your loan servicer. You may log into the National Student Loan Database System (NSLDS) to access your loan servicer information.

Federal Perkins loans

If you have a Federal Perkins Loan you received through NMHU, you can access your loan account, update your personal information, and make payments online at NMEAF.

Payment can also be mailed to:

New Mexico Educational Assistance Foundation (NMEAF)

7400 Tiburon NE, Ste. F

Albuquerque, NM 87109

Phone: 505-345-3371

Toll-free: 1-800-279-5063

Email: info@nmeaf.org

Private/Alternative Loans

When federal student loans and other aid do not cover your cost of education, private or alternative educational loans are available. Make sure that you have explored all federal aid options before requesting a private loan. Federal student loans are required, by law, to provide a range of flexible repayment options including, but not limited to, income-based and income-contingent repayment plans, as well as loan forgiveness benefits, that other student loans are not required to provide.

If needed, we recommend that you compare private loans and find the loan rates and terms that meet your specific needs. Private educational loan programs vary by lender. It’s important that you contact individual lenders to find out about terms and conditions that may apply.

ELM Select is a free service that offers an unbiased search for private student loans with no registration required. The lenders in ELM Select are listed based upon their historical lending with NMHU students.

Visit ELM Select at https://www.elmselect.com/v4/. Enter “New Mexico Highlands University” in the search bar, select your program (Graduate or Undergraduate), then click “View Loans”.

Please Note: The Office of Financial Aid and Scholarships at NMHU does not endorse, promote or recommend any lender for private loans.